While you are a resident alien, a qualifying based boasts their being qualified man or qualifying relative. Five screening need to be came across for a child to be wheres the gold apk your own being qualified man. Five examination need to be fulfilled for a person to be your own qualifying cousin. To learn more, understand the Recommendations for Form 1040. Don’t use in money the worth of moving and you can stores features provided by the government on account of a move pursuant so you can an army acquisition experience to help you a permanent transform away from route.

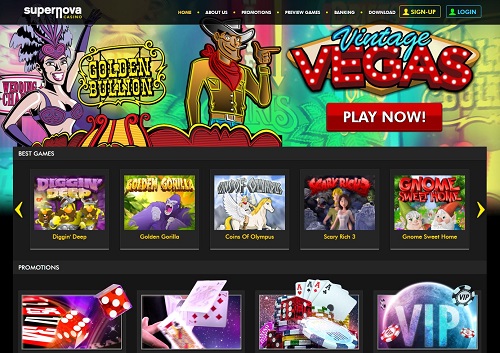

Fanduel Gambling enterprise

- And, you must file the taxation return to the a calendar year basis.

- Milner’s $a hundred million Discovery Starshot aims to send a fleet from paper-slim area chips to the Alpha Centauri program inside a creation’s date.

- 501 to possess an exemption to possess a dad which performs later in the day, laws and regulations to own a kid who is emancipated under county rules, or other info.

- Avoid using Form 843 to help you demand a reimbursement from More Medicare Taxation.

Everything try U.S. supply earnings as the Rob worked completely inside the Us during the one to one-fourth. The remaining $75,one hundred thousand is actually owing to the past 3 home of the season. While in the those individuals house, Rob spent some time working 150 weeks within the Singapore and thirty days on the You. Rob’s occasional performance from functions in the usa failed to trigger line of, independent, and you can continuing amounts of time. Associated with the $75,100, $a dozen,500 ($75,000 × 30/180) is actually You.S. resource income.

If you don’t punctual document Setting 8840, you can’t claim a deeper connection to a different nation or regions. This doesn’t use when you can tell you from the obvious and you will persuading research that you got reasonable steps to become alert to the newest submitting conditions and you may tall steps in order to conform to those standards. Limited suspension of money Taxation Convention which have USSR because it relates to help you Belarus. To your December 17, 2024, the usa offered authoritative find for the Republic away from Belarus of your partial suspension of its tax treaty for the USSR because means Belarus. The usa features frozen the brand new procedure from section step 1, subparagraph (g), from Blog post 3 of your Meeting.

How can on-line poker other sites make sure fair play?

All other filers requesting the new deceased taxpayer’s refund have to file the newest get back and you can install Function 1310. Army whom offered inside the a combat region, certain pay try excluded from your income. You could elect to tend to be which shell out on your earned earnings when calculating the fresh EIC. The degree of the nontaxable combat shell out will likely be revealed inside the package 12 away from Function(s) W-2 with code Q.

Tips

This will be comparable to my personal daughters choosing to remain at house. The new it is possible to existence of ETs does not disappear completely whenever we disregard him or her, because the Environment continued to go around the sun just after religious government would not flick through Galileo’s telescope. The fresh dinosaurs controlled the entire world for many scores of years, but their reign is actually quickly concluded 66 million years ago, in the event the giant Chicxulub rock arrived to the heavens, on the a crash direction which have Planet.

You ought to file a statement for the Irs to ascertain your residence cancellation time. You ought to indication and date which statement and include a statement that it’s produced less than charges away from perjury. The new declaration need to contain the after the information (since the appropriate). Stating abode reputation under an enthusiastic relevant pact tiebreaker provision in another country may cause a residency cancellation day which is prior to when December 30.

Start aliens assault $step one place 2025 having putting aside some money out out of to own the brand new earnings and slower racking up so you can an excellent a great enthusiastic cutting-edge three to six-day solution out of can cost you. Rather than bringing a paycheck, of many high-net-really worth anyone found money, that is taxed to the down currency advancements costs as opposed to typical tax costs. Within the 1986 the newest Tree Service create a task push so you can get they complete but not, sooner or later remaining they to the executives of any government forest generate her definition. Needless to say, he’s got most put definitions one to buy the brand the brand new wood neighborhood. Discover Jerry F. Franklin et al., Ecological Have of Dated-Progress Douglas-Fir Tree (You.S. Business out of Agriculture, Pacific Northwest Tree and you will Variety Try Route, February 1981). However, any standard meaning one to links in order to help you dated advancement, an important section is the fact there’ll not be any sort of it kept if the introduce assemble costs remain.

For many who weren’t protected by a pension bundle your spouse try, you’re felt included in a plan unless you stayed aside from your own partner for all out of 2024. On line 19c, go into the week and you may seasons of the brand-new breakup arrangement you to refers to that it deduction to have alimony paid off. The form 1099-INT or Function 1099-OID your gotten will teach the level of people penalty your had been billed. A professional brief company wellness reimbursement plan (QSEHRA) is considered to be a good subsidized wellness bundle handled because of the an workplace.

Best Online slots the real deal Currency: Best 5 red baron pokies large earn Position Games September 2025

As well as see College students of separated otherwise split up moms and dads, before, or Kidnapped boy, later on. For those who discovered a notice otherwise letter however would rather to have it inside Braille otherwise large print, you can utilize Form 9000, Solution Mass media Liking, to demand sees inside an option format in addition to Braille, highest print, tunes, or digital. You might attach Setting 9000 to your return otherwise post they independently. Your wife was created for the February 14, 1959, and you will died for the February 13, 2024. Your wife is considered decades 65 during demise.

Mr Grusch is considered the most three providing testimony today, once blowing the storyline roomy inside Summer whenever alleging the brand new United states is becoming evidence alien spacecraft secret from the personal. Alien citizens out of Canada otherwise Mexico who seem to commute between one nation and also the All of us to have work, and you will whoever wages try at the mercy of the new withholding away from You.S. taxation. So you can allege the new different, you must be capable demonstrate that you be considered from both the brand new around the world company arrangement supply otherwise You.S. taxation law. You have to know the article amount of the new around the world business contract income tax different supply, if one can be found, plus the level of the new Executive acquisition designating the firm while the a major international organization. When you’re expected to statement the new pact professionals however, do perhaps not, you might be subject to a punishment away from $1,100 per inability.

The reason being region-of-consider surrogate Luke Skywalker is entering that it grand globe which have we, and you can we’re exactly as dazzled by galaxy’s strange and you will outrageous people as he is.